Generation of Realistic Synthetic Financial Time-Series

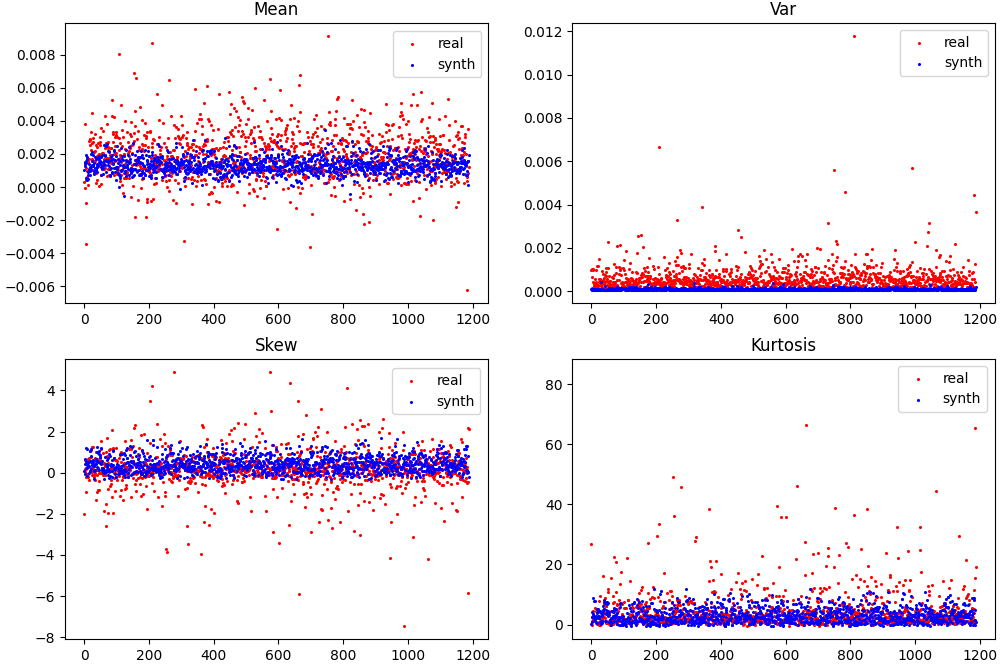

Financial markets have always been a point of interest for automated systems. Due to their complex nature, financial algorithms and fintech frameworks require vast amounts of data to accurately respond to market fluctuations. This data availability is tied to the daily market evolution so it is impossible to accelerate its acquisition. In this paper, we discuss several solutions for augmenting financial datasets via synthesizing realistic time-series with the help of generative models. This problem is complex since financial time series present very specific properties, e.g., fat-tail distribution, cross-correlation between different stocks, specific autocorrelation, cluster volatility etc. In particular, we propose solutions for capturing cross-correlations between different stocks and for transitioning from fixed to variable length time-series without resorting to sequence modeling networks, and adapt various network architectures, e.g., fully connected and convolutional GANs, variational autoencoders, and generative moment matching networks. Finally, we tackle the problem of evaluating the quality of synthetic financial time-series. We introduce qualitative and quantitative metrics, along with a portfolio trend prediction framework which validates our generative models’ performance. We carry out experiments on real-world financial data extracted from the US stock market proving the benefits of these techniques.

Please find all the details about the data set in the draft of the main paper [here].

@inproceedings{dogariu2022generation,

author = {Dogariu, Mihai and {\c{S}}tefan, Liviu-Daniel and Boteanu, Bogdan Andrei and Lamba, Claudiu and Kim, Bomi and Ionescu, Bogdan},

title = {Generation of Realistic Synthetic Financial Time-Series},

booktitle = {ACM Transactions on Multimedia Computing, Communications, and Applications (TOMM)},

year = {2022}

}